IRS: Renew Individual Taxpayer ID Numbers By Dec. 31

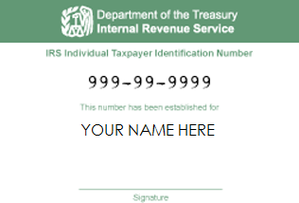

Taypayers with expiring Individual Taxpayer Identification Numbers (ITINs), are reminded by the Internal Revenue Service to submit their renewal applications as soon as possible. Failing to renew them by the end of the year will cause refund and processing delays in 2018.

The IRS mailed letters over the summer to more than one million taxpayers whose ITINs are set to expire at the end of the year—those with middle digits 70, 71, 72 or 80. In addition, any ITIN that has not been used on a federal tax return at least once in the last three consecutive years will also expire at the end of the year. Affected taxpayers who expect to file a tax return in 2018 must submit a renewal application by the deadline.

Who Should Renew an ITIN?

Taxpayers with ITINs set to expire at the end of the year and who need to file a tax return in 2018 must submit a renewal application. Others do not need to take any action.

- ITINs with middle digits 70, 71, 72, or 80 (For example: 9NN-70-NNNN) need to be renewed if the taxpayer will have a filing requirement in 2018.

- Taxpayers whose ITINs expired due to lack of use should only renew their ITIN if they will have a filing requirement in 2018.

- Taxpayers who are eligible for, or who have, an SSN should not renew their ITIN, but should notify IRS both of their SSN and previous ITIN, so that their accounts can be merged.

- Taxpayers whose ITINs have middle digits 78 or 79 that had already expired and were never renewed should renew their ITIN if they will have a filing requirement in 2018.

How to Renew an ITIN

To renew an ITIN, taxpayers must complete a Form W-7 and submit all required documentation.Although a Form W-7 is usually attached to the tax return, a taxpayer is not required to attach a federal tax return to their ITIN renewal application.

There are three ways to submit the W-7 application package:

- Mail the Form W-7, along with original identification documents or copies certified by the issuing agency, to the IRS address listed on the Form W-7 instructions. The IRS will review the identification documents and return them within 60 days.

- Taxpayers have the option to work with Certified Acceptance Agents (CAAs) authorized by the IRS to help them apply for an ITIN. CAAs can certify all identification documents for primary and secondary taxpayers and certify that an ITIN application is correct before submitting it to the IRS for processing. A CAA can also certify passports and birth certificates for dependents. This saves taxpayers from mailing original documents to the IRS.

- In advance, taxpayers can call and make an appointment at a designated IRS Taxpayer Assistance Center instead of mailing original identification documents to the IRS. When making an appointment, be sure to indicate that this involves an ITIN renewal application.

The ITIN renewal requirement is part of a series of provisions established by the Protecting Americans from Tax Hikes (PATH) Act enacted by Congress in December 2015. These provisions are outlined in IRS Notice 2016-48.

The IRS has a special page with steps to take now for the 2018 tax filing season.

Sponsored Content

Comments

_1770333123096.webp)