Big Island’s Tax Burden Rating Among Lowest in the State

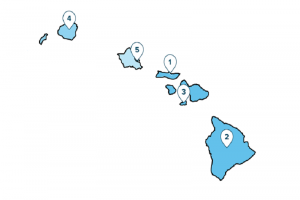

This graphic shows the ranking of each County in Hawai’i in Smart Asset’s Tax Burden Index. SmartAsset image.

Hawai’i County ranked second in the state in terms of lowest tax burdens on residents.

The information is part of a recent SmartAsset study analyzing what a person making the United States median income pays for sales, property, and fuel tax across the country.

Hawai’i ranked second to Kalawao County, a section of Molokai.

Across the state, the average income tax was noted at $10,578 and the average sales tax was listed at $594, with the exception of Honolulu, which averaged $669, according to the report.

The Big Island saw a fuel tax average of $515, the lowest of all the counties except for Kalawao, with a fuel tax of zero.

On the Big Island, the tax burden index was determined to be a rating of 69.68, behind Kalawao’s 73.07.

Maui, Kauai, and Honolulu rounded out the list as third, fourth, and fifth, respectively.

Nationwide, the best tax burden rating was found in Yukon Koyukuk, Alaska, scoring a perfect 100.00, with no sales tax, an income tax average of $7,992, a property tax average of $369, and a fuel tax average of $114.

Sponsored Content

Comments

_1770333123096.webp)