Big Island Real Estate Breaks Records in 2018 Despite Kīlauea Eruption

Despite multiple lava outbreaks in the lower Puna District, most of the residential real estate market on Hawai‘i’s Big Island managed to post impressive numbers in 2018, with an islandwide average pricing increase of 2.4% from the prior year.

That average can be traced to record-breaking performance in key markets, which managed to offset painful losses elsewhere on the island.

Home Prices Rise Amid Lava Chaos

As hundreds of houses were destroyed in Puna’s Leilani Estates and Kapoho, causing a near-complete (and predictable) collapse of housing markets there, several miles away in Hawaiian Paradise Park, home values surged 12% year-over-year, helped in part by residents relocating from lava-inundated areas.

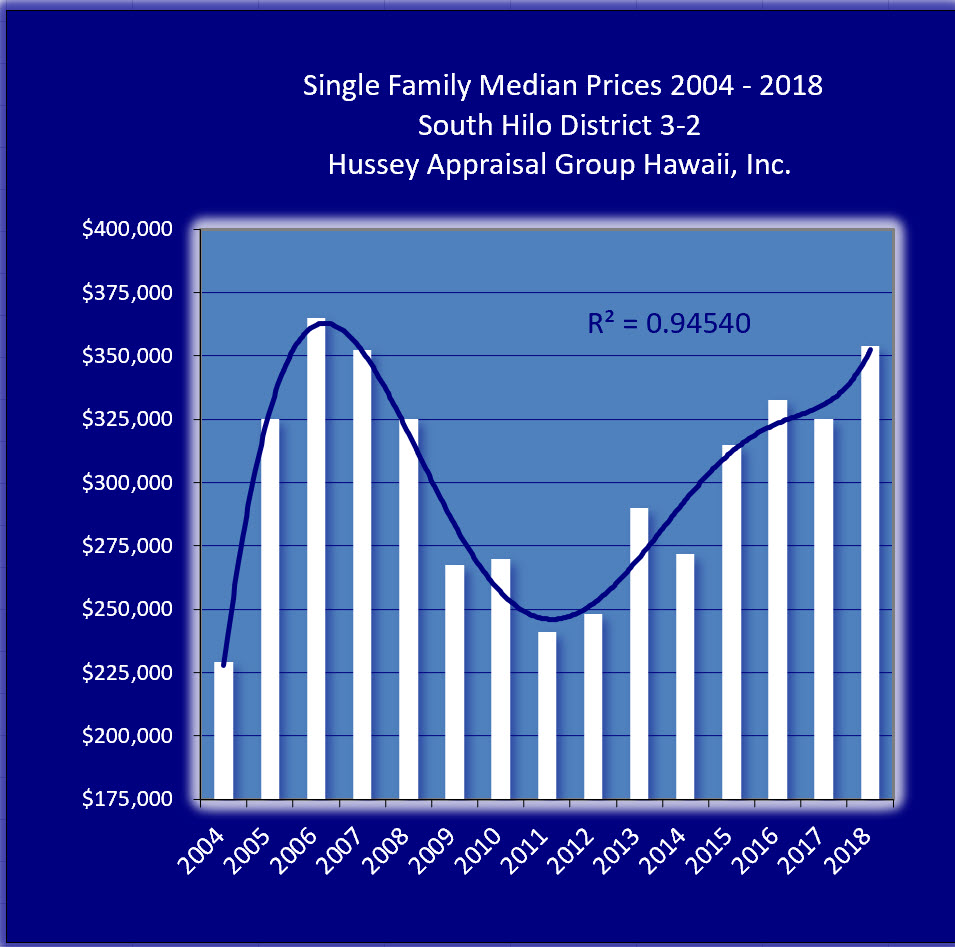

Meanwhile, the South Hilo District, the bedrock of East Hawai‘i’s housing market, posted an impressive 9% gain in home values, with an average home price of $353,750. The previous year had seen home prices in the area averaging $325,000.

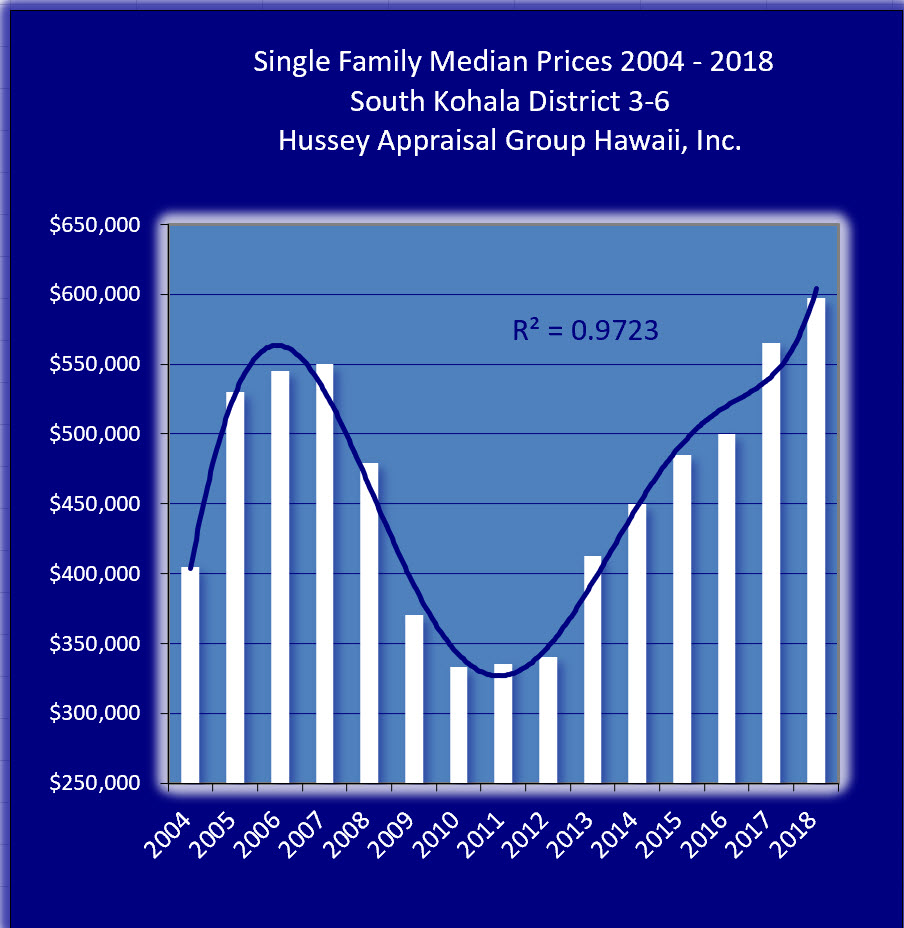

South Kohala showed equally impressive performance, with year-over-year housing prices rising 6% to an average of $597,000, soaring past the previous all-time-high average of $545,000 in 2006.

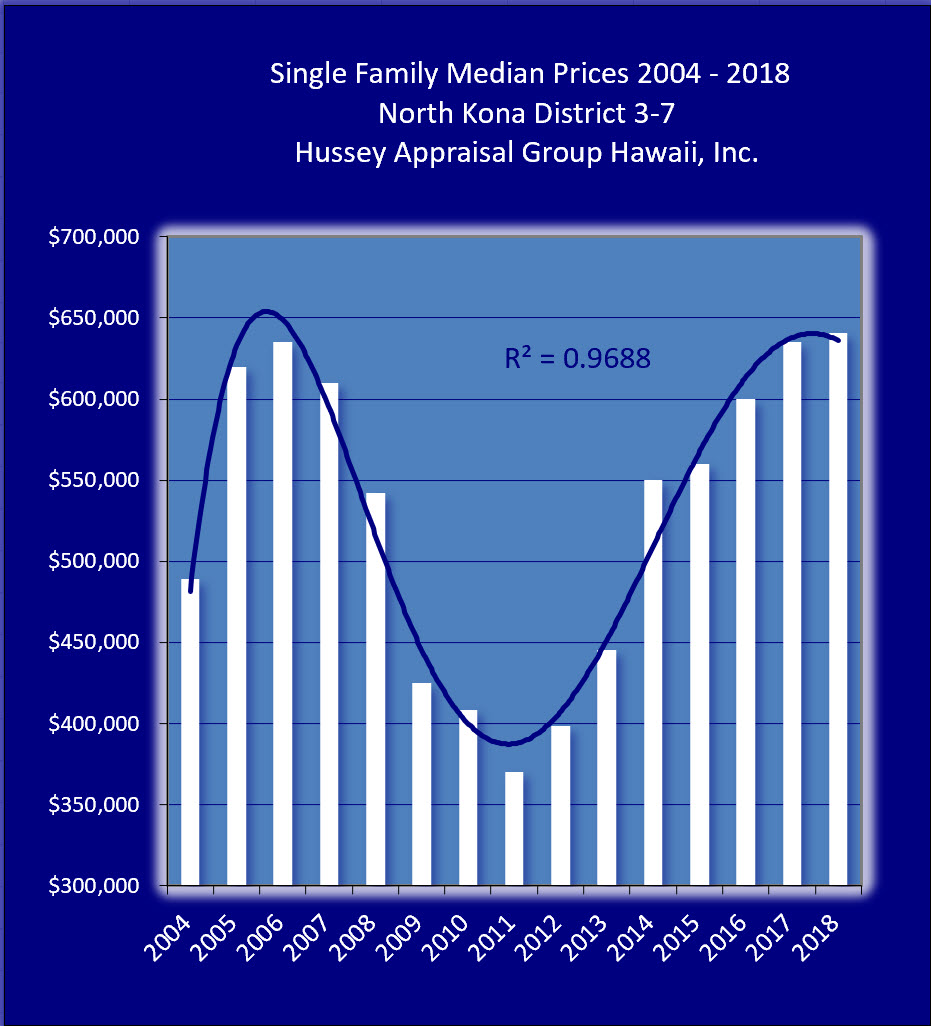

Even the North Kona District, heavily impacted by volcanic smog (vog) during the year’s lava outbreaks, managed to maintain stability and even squeeze past previous highs, with housing prices rising 1% to an average of $640,500, just above the $635,000 average seen in 2006.

Meanwhile, prices in North Kohala saw a spike of 18% in 2018. While a more difficult market to track due to limited property availability, the district has seen sustained growth in recent years.

Residential home prices in Hāmākua, South Kona and Ka‘ū were all relatively stable throughout the year.

Commercial & Condo Markets Surge

Taken as a whole, Big Island condominiums continue to see strong performance, with overall prices surging nearly 13% when compared to 2017 and multiple real estate firms reporting low vacancy rates for long term rentals.

Laura Baurin, an MAI appraiser with Hussey Appraisal Group Hawai`i, confirmed that trend in an email exchange with Big Island Now, noting, “Most projects are at or near full occupancy and rents remain relatively high.”

Baurin noted similarly hot performance in the Big Island’s commercial real estate sales market for 2018. While the volume of commercial sales on the Big Island is relatively small when compared to other markets, Baurin explained that paired sales statistics “indicate upward price movement of about 5% to 7% per year in East Hawai`i and 10% per year or more in West Hawai`i.”

Industrial lease rates also remain strong, according to Baurin, with rates as high as $1.15 per square foot.