What’s the Forecast for Hawai‘i’s Economic Recovery with Looming U.S. Recession?

You might have heard that when the United States economy goes one direction, about six months later Hawai‘i’s follows suit.

“That’s not true,” Carl Bonham, executive director of the University of Hawai‘i Economic Research Organization, or UHERO, said Thursday during a press conference via Zoom.

In two of the past four recessions, “Hawai’i basically grew right through the U.S. recession — at least grew much more than the U.S. economy did, which was shrinking,” Bonham said.

UHERO’s latest forecast for the state says the economic horizon has darkened, with the global economy slowing sharply and the U.S. economy likely heading into a mild recession in the first half of next year.

Hawai‘i could escape some of the pain, which is outlined below, but the expected recession will weigh on the islands’ economic recovery from the COVID-19 pandemic.

“Global growth has slowed to about 3% this year and will soften further in 2023,” the UHERO report says.

Persistently high inflation is causing interest rates to soar. Russia’s continued war with Ukraine is causing an energy crisis in Europe, which is now clearly headed toward a recession. China’s economy is suffering from its zero COVID policy.

In the United States, the Federal Reserve on Wednesday hiked interest rates again, this time by three-quarters of a percentage point, to try to reduce spending to combat inflation of more than 8%. High mortgage rates already have wreaked havoc on the national housing market and household budgets are being ransacked by the high inflation and rising interest rates that are reflected on credit card rates, car purchases and the like.

“While labor markets remain tight for now, we expect U.S. growth to manage just 0.3% next year,” the UHERO report says.

The main story for Hawai‘i, Bonham said Thursday, is that the state is out of sync with the rest of the country.

“So there is a possibility that Hawai‘i could get through this without much of a downturn,” he said. “It’s mostly because we’re still in recovery mode; we still have a ways to go.”

Hawai‘i’s labor market is tight, with unemployment at just more than 4%, and job growth in the state is expected to slow from more than 5% this year to just less than 2% in 2023.

“We are talking about a much slower rate of job creation throughout 2023,” Bonham said. “So instead of seeing 2,000 or 1,000 jobs added per month, we’re going to be looking at getting down into the sub-500 jobs each month. And with some growing labor force, we’re going to see an increase in unemployment.”

While many employment sectors are already experiencing weakness, one sector could make all the difference in how the state fairs economically.

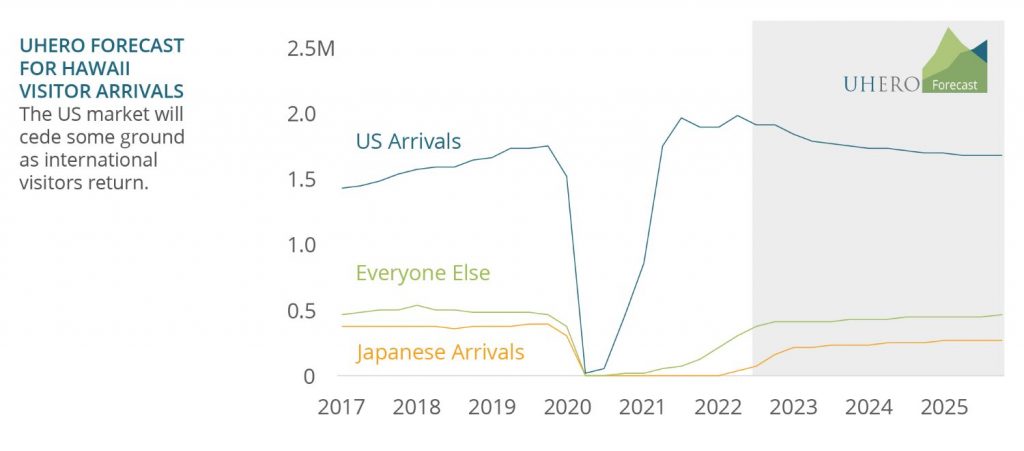

It has been a topic of debate for years, especially since the pandemic began — keep embracing tourism or diversify. The continued recovery of the visitor industry, however, could help Hawai‘i escape overall net job losses thanks to increasing numbers of international visitors, especially those from Japan.

“We still think there is pent up demand for visits to Hawai‘i by Japanese visitors,” Bonham said. “We haven’t seen that yet. We’re beginning to see an improvement in the Japanese market.”

UHERO thinks by the first quarter of 2023, Hawai‘i will be back at about 50% of pre-pandemic levels for Japanese visitors. Japanese passenger counts sat at just 10% of pre-pandemic levels in June but that number had doubled by August. Overall, passenger counts on international flights from June through August climbed from about a quarter to more than a third of their levels from before the pandemic began, according to the report.

“So essentially what’s going on in our forecast is that international visitor spending is expected to offset a decline in U.S. visitor arrivals and spending,” Bonham said. “That essentially keeps us level in tourism.”

But the impacts won’t be felt the same across the board in the islands.

“The negative impacts of the U.S. recession are going to be felt most acutely on Maui and Kaua‘i, on the two markets that are predominantly U.S. markets,” Bonham said. “In contrast, because of our anticipated relatively strong return of Japanese visitors and spending, the smallest effects and the best growth will be seen on O‘ahu and the Big Island, where you can actually imagine starting to see businesses that cater to Japanese visitors starting to come back.”

If the number of international visitors doesn’t continue to grow and a decline in visitors from the U.S. mainland is realized, the situation would change for Hawai‘i. Bonham said in that case, the state would be in an outright recession and see job losses instead of small gains.

Other factors will play key roles in how well the state’s economy weathers the coming economic storm, too.

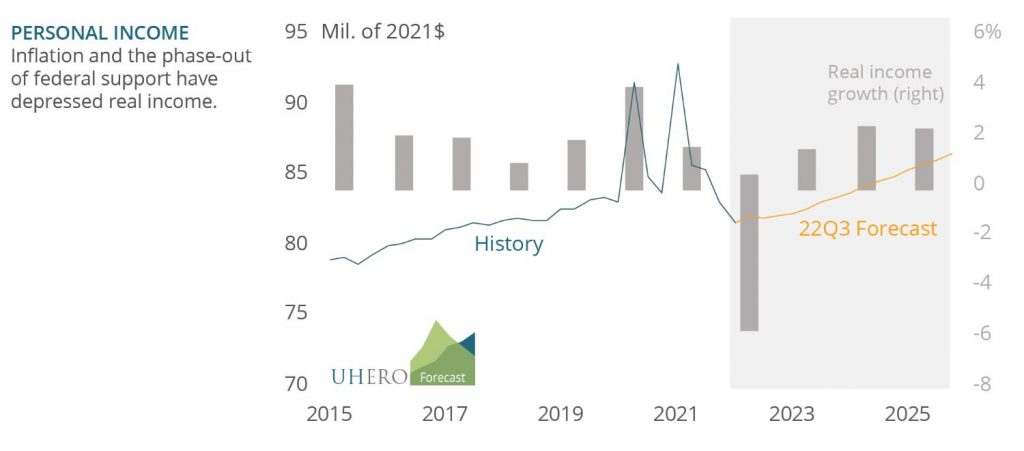

Higher travel costs and additional interest rate hikes by the Federal Reserve will adversely impact Hawai‘i households and businesses. High inflation, while lower in Hawai‘i than on the mainland, also will continue to inflict pain. The UHERO forecast says nominal wage gains in the state are not keeping up with increasing prices.

Added with the end of federal pandemic support programs, and real income is also being dragged down, with real income from all sources in the state expected to decline more than 5% this year.

Cost pressures also will continue to challenge the construction sector next year. But Bonham said Thursday the state is seeing an increase in federal spending on construction, including infrastructure and road projects from the Inflation Reduction Act, and in U.S. Department of Defense spending, which offers some relief.

“Our forecast for government contracts, mostly federal dollars, is about $2 billion higher than the average level of government contracts every year for the next four or five years,” he said.

The UHERO forecast says the long-awaited return of Japanese visitors and robust public sector construction will likely offset U.S. weakness and keep Hawai‘i job growth in positive territory. There are troubling risks, however, such as the impact of a very weak yen, potentially larger interest rate hikes by the Federal Reserve than anticipated and a deeper U.S. fall.

The fallout: a return to satisfactory economic progress in Hawai‘i probably won’t begin until 2024.

“The takeaway is a modest U.S. recession, a pretty marked slowdown for Hawai‘i that will sort of put a pause on our recovery and then some resumption of that recovery in 2024,” Bonham said.

For more economic information or to read the forecast, visit the UHERO website.