Bill to Lower Taxes, Increase Food and Excise Credit

Big Island House Rep Chris Todd has introduced a bill to lower taxes on the low- and middle-class wage earners to help prevent and reduce homelessness.

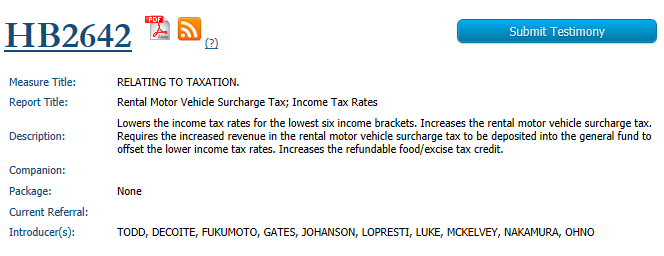

House Bill 2642 would reduce the cost of living for Hawai‘i residents by:

- Lowering the income tax rates for the lowest six income brackets

- Increasing the rental motor vehicle surcharge tax

- Requiring the increased revenue in rental motor vehicle surcharge tax to be deposited in the general fund to offset the lower income tax rates

- Increasing the refundable food/excise tax credit.

“Hawai‘i residents are having difficulty making ends meet, especially in the lower- and middle-income groups,” said Rep. Todd (Keaukaha, Hilo, Pana‘ewa, Waiākea). “Allowing this group to keep a little more of their hard earned money could also prevent some families from falling into homelessness.”

Depending on total income, the bill doubles the food/excise tax credit to between $110 and $220 for individuals earning $30,000 or less. For people filing joint returns the credit will be doubled to between $70 and $200 for those earning $50,000 or less.

The bill has been introduced and passed first reading.