Study: Hawai‘i No. 2 in the Nation for Cost-burdened Renters

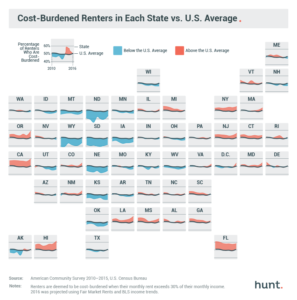

Hawai‘i ranks among the top five states in the nation for highest share of cost-burdened renters, according to a new study exploring student debt and rent expenses for young college graduates.

A research team at Hunt.com combined and analyzed recent graduate income and student debt figures with rental prices from a sample of two million Hunt.com property listings between May 2016 and May 2017.

The findings revealed that 57.4 percent of Hawai‘i residents are cost-burdened, tied for the No. 2 spot in the nation with California. According to the U.S. Department of Housing and Urban Development (HUD), cost-burdened is defined as any renter who spends more than 30 percent of their monthly income on housing.

The top five ranking states for cost-burdened renters in the nation were Florida (58.7 percent), California (57.4 percent), Hawai‘i (57.4 percent), Oregon (54.7 percent) and New Jersey (54.2 percent).

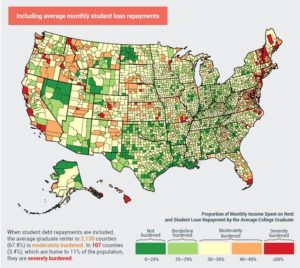

Nationwide, the average college graduate was found to be cost-burdened in 17 percent of U.S. counties. When student loan payments were added to the figures—which average $221 per month—that number quadrupled to 71 percent. The study concluded that 3.6 million U.S. college graduates are being pushed “into the red” by student loan repayments and the rising cost of rent.

What are the causes behind this trend? According to the study, average college graduate earnings have either remained the same or fallen in recent years; fewer rental properties are now available to rent than in 2009; and rent prices for vacant properties have increased and continue to rise. In addition, the average student debt is now $34,000—70 percent more than 10 years ago.

The researchers concluded that one third of graduates aged 25 to 34 are at risk of being moderately burdened by rental costs; 11 percent are at risk of being severely cost-burdened.

Despite this trend, at least one expert contends that college graduates are still better off financially in the long run. According to Cleveland Fed economist Joel Elvery, student loan borrowers who pay back between $203 and $400 per month will earn $750 more each month than people of the same age with only a high school degree.