IRS: Now Is a Good Time to Get Current on Taxes

The Internal Revenue Service (IRS) has issued a notice reminding taxpayers who have not filed for a 2016 tax return or prior years that now is a good time to get current.

Though some with unfiled returns owe back taxes, many are due refunds. Federal law limits refund claims for most taxpayers to three years from their due date. Otherwise, refunds owed become the property of the U.S. Treasury.

Not all taxpayer are required to file, but there are still reasons to file due to potential refunds or eligibility for certain tax credits, according to the IRS.

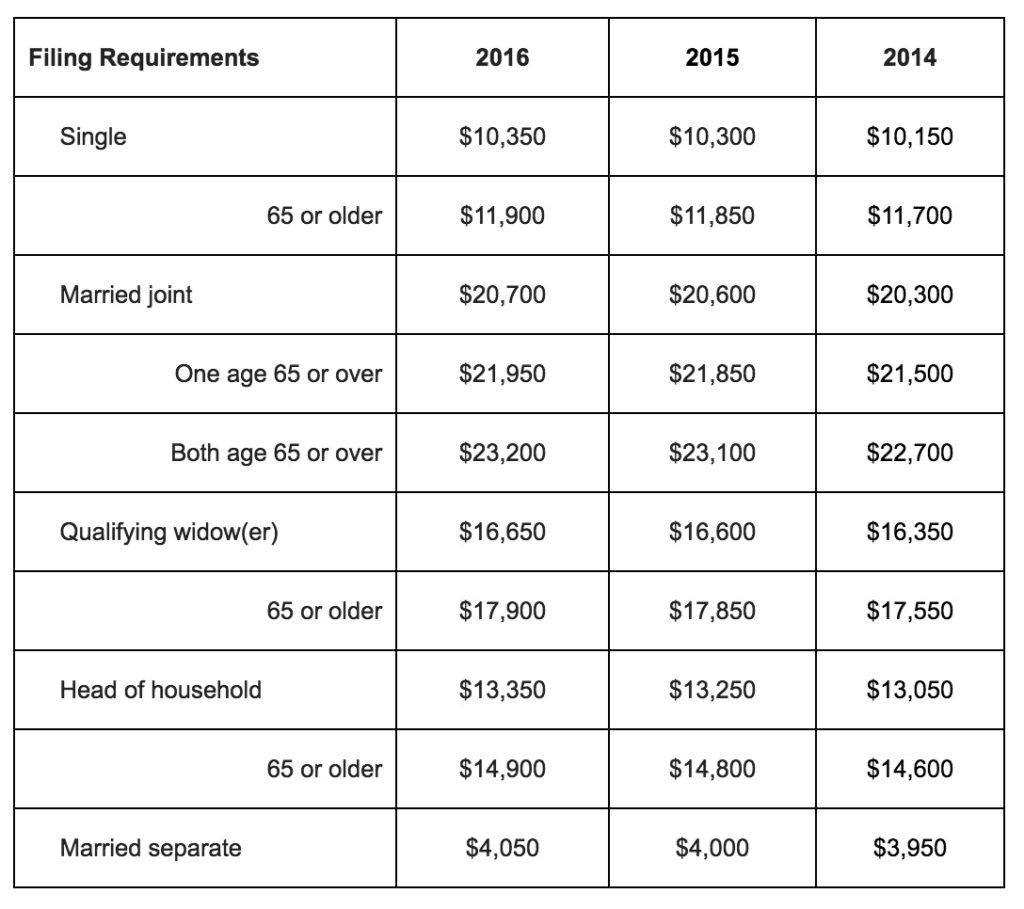

Filing requirements generally apply to U.S. citizens and residents depending on gross income, filing status and age. Dependents, certain children under the age of 19 or full-time students, self-employed persons and alien residents may also have a filing requirement. Many low- and moderate-income workers who did not file may be eligible for the Earned Income Tax Credit. The EITC was worth as much as $6,143 for tax year 2014; $6,242 for 2015; and $6,269 for 2016.

There is no penalty for filing a late return if a taxpayer is due a refund. Accordingly, because penalties and interest only apply to unpaid taxes, anyone due a refund should file as soon as possible to receive a return.

According to the IRS, some reasons why people do not file include:

- Do not earn enough to have a filing requirement;

- Do not know how to file because they are not fluent in English;

- May not have all the documents they need and are afraid to file late;

- May owe more tax than they can pay and think it’s better not to file.

Taxpayers Who Owe

Under U.S. law, the IRS may assess penalties for filing a late return or paying taxes past their due date. The penalty for filing late is normally five percent of the unpaid taxes for each month or part of a month that a tax return is late. That penalty, usually capped at 25 percent, starts accruing the day after the tax filing due date. A reduction of these penalties may be considered if the taxpayer can show reasonable cause for being late.

Similarly, a failure-to-pay penalty may apply if not all taxes owed are paid by the tax filing deadline. Normally, the penalty—capped at 25 percent—is half of one percent of the unpaid taxes and applies for each month or part of a month after the due date. Like the late filing penalty, this penalty starts accruing the following day after the tax-filing due date.

Interest charges will accrue daily on any amount not paid, including on both penalties and interest. The interest rate—currently four percent per year, compounded daily—is the federal short-term rate plus three percent.

Other penalties may be imposed for negligence, substantial understatement of tax, reportable transaction understatements, filing an erroneous refund claim and fraud. A penalty of $5,000 may be imposed for filing a frivolous return. Criminal penalties may be imposed for willful failure to file, tax evasion or making a false statement.

Payment Options

The IRS offers several relief programs for those struggling to pay taxes to make it easier to repay monies owed and avoid tax liens. Those who need more time to pay can request an installment agreement or may qualify for an offer in compromise.

Individuals who owe $50,000 or less in combined individual income tax, penalties and interest, and have filed all required returns may request an installment agreement. Taxpayers may also consider an offer in compromise (OIC) where a given tax liability is resolved for less than the full amount owed. Generally, an OIC is approved when the amount offered represents the most the IRS can expect to collect within a reasonable period.