GET Surcharge Would Generate $50 Million for Big Island

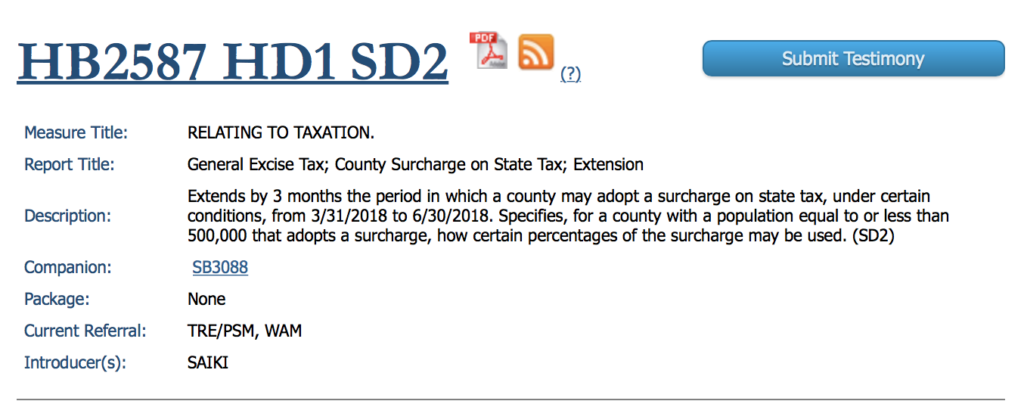

Hawai‘i County Mayor Kim wrote the following letter to the Hawai‘i County Council, requesting its support of the GET surcharge outlined in HB2587, which is now before the State Legislature. Mayor Kim explains that members of the Legislature responsible for HB2587 have made changes that is so beneficial to the needs of Hawai‘i County. He says the measure “is an extraordinary opportunity for our county to expand our tax base and tremendously reduce the need to raise property taxes in the future.”

Hawai‘i County Mayor Kim wrote the following letter to the Hawai‘i County Council, requesting its support of the GET surcharge outlined in HB2587, which is now before the State Legislature. Mayor Kim explains that members of the Legislature responsible for HB2587 have made changes that is so beneficial to the needs of Hawai‘i County. He says the measure “is an extraordinary opportunity for our county to expand our tax base and tremendously reduce the need to raise property taxes in the future.”

The letter reads as follows”

A .5% charge would be added to the 4% state general excise tax (GET) currently paid.

A half-cent GET surcharge would add 54 cents in tax to a $100 expenditure.

Dear Ms. Poindexter & Council Members,

RE: Proposed General Excise Tax (GET) Surcharge

The State Legislature is considering extending the opportunity for counties to adopt a GET surcharge (HB2587). Current estimates just received from the State Tax Research & Planning Officer, Department of Taxation, State of Hawai‘i are double the previous estimates presented to the County Council. This corrected estimate was due to the method of allocation to the counties.

I strongly support HB2587 and request the County Council to support the GET Surcharge. I do understand the approval of HB2587 is still uncertain but have been informed of the positive influences the administration and especially the County Council support would have on its outcome.

Members of the Legislature responsible for HB2587 have made changes that is so beneficial to the needs of Hawai‘i County. Those changes relate to how the revenues are to be spent and is explained further in the attachment [the document below]. Should HB2587 pass and the County Council enact the GET Surcharge Ordinance, this administration commits to the County Council a fully cooperative approach in setting priorities on the expenditures of these additional revenues. Thank you,

Harry Kim, Mayor

GET Surcharge – An Opportunity to Generate Revenue to Better Serve the Community

The State Legislature is considering extending the opportunity for counties to adopt a new tax revenue source that would generate an estimated $50 million a year, based on the state’s most recent projections, through a .5% General Excise Tax (GET) surcharge (HB 2587). The bill extends the deadline for County Council adoption to June 30, 2018. This is an extraordinary opportunity for our county to expand our tax base and tremendously reduce the need to raise property taxes in the future.

Limited County Revenue Sources. The state holds the power to determine how counties can generate revenue to run county operations. Of the state’s 17 tax sources, the counties control the rates of only three: property tax, vehicle weight tax, and fuel tax. Our county relies heavily on property taxes—this source currently generates approximately 74.5% of the general fund revenues.

Significance of the GET Surcharge Revenues. The estimated annual revenues of $50 million from the GET surcharge would significantly reduce our reliance on property taxes, thereby reducing the need to raise property taxes in the future. If we had to raise property taxes to generate a comparable amount of $50 million, that increase would equate to a 16.5% increase. Instead, we have an additional $50 million with no increase in property taxes.

Basic Facts on Hawai‘i’s GET. The GET is a tax on gross income of businesses. Most businesses that sell goods or provide services must pay the GET. This covers everything from store purchases to construction fees. Businesses pass on this tax to consumers. The GET is the state’s largest source of income. With the surcharge, the GET will increase from 4% to 4.5%. The state will collect the 4.5% tax, keep 4%, and return 0.5% of the GET revenues generated from this county. It is estimated that 99% of the county’s portion will go to the county, and 1% will go to the state for administrative costs.

Beneficial Uses of the .5% Surcharge Revenues.

Transportation

One version of the bill mandates that 60% of the revenues be used for transportation projects which could include:

Mass Transit

A fleet of new buses that we can be proud of, that will serve those most in need, and also provide more accessible services to our rural areas such as Hamākua, Kā’ū and Puna;

Development of a bus scheduling system that people can rely on to get to work, school, the doctor and shopping.

Road Improvements

To address the backlog of public road repairs and improvements;

To address street lighting problems to improve roadway safety;

To address backlog of traffic striping islandwide;

To develop new connections or widened roads that could help alleviate gridlock or shorten trips.

Trails, Pathways, and Sidewalks

To address improvement of trails and safe routes to school;

To develop new trails and pathways to promote an active and healthy lifestyle and alternative modes of transportation, including bicycle and pedestrian facilities.

Private Roads

Of the 60%, 2% of the transportation-related revenues could be used to improve private roads that are used by the general public. This is the first time the Legislature has recognized the unique status of these private roads that function as public roads.

General Revenues

The remaining 40% would become part of the general revenues that could be used to pay for other programs and services, such as:

- Homeless program and services;

- Improved emergency responder services (police and fire);

- Parks maintenance;

- Other needs.

Visitors Will Contribute

Of the estimated $50 million collected each year, visitors to this island will contribute approximately 25% of that amount, thereby expanding the tax base supporting our county budget. There were about 1.6 million visitors to our island in 2016 whose daily spending would be taxed by this GET surcharge.

Impact to Lower Income Households

The GET surcharge of 0.5% means that the tax on a $100 expenditure will increase by 54 cents, raising the total bill from $104.16 to $104.70. However, several programs reduce this additional tax burden on lower income households:

Housing If property taxes are raised, this impacts everyone–homeowners as well as renters. Besides not having to raise property taxes, the GET surcharge would not impact renters who are eligible for Section 8 rental subsidies since any increase beyond 30% of their income is paid by government.

Eligible food purchases under the Federal Food Assistance Programs are exempt from GET.

Medicaid and the Children’s Health Insurance Program (CHIP) provide free or low-cost health coverage to low-income people, families and children, pregnant women, the elderly, and people with disabilities. Prescribed drugs and prosthetic devices are exempt from GET.

Children from birth to age five from families with low income, according to the Poverty Guidelines published by the Federal government, are eligible for Head Start and Early Head Start services. Children in foster care, homeless children, and children from families receiving public assistance (Temporary Assistance for Needy Families or Supplemental Security Income) are categorically eligible for Head Start and Early Head Start services regardless of income.

Income Tax Credit. Households may be eligible for tax credits for child and dependent care expenses, earned income, and rent.

Without the .5% GET surcharge, this county will have a balanced budget that barely maintains current services—roads will get repaved every 30 years, police and fire will do their best to respond to growing population needs, the bus system will limp along with minimal improvements, county parks will continue at low maintenance levels.

With the GET surcharge, we have a tremendous opportunity to use these additional funds to really make a difference, which will make Hawai‘i Island a nicer and safer place to live, work and visit.