Bill Helps Consumers Protect Themselves From Data Breaches

Recent news that an additional 2.4 million American consumers had their personal information stolen during the Equifax data breach shows the need for a law making credit freezes free in Hawai‘i, said a March 1, 2018, press release from AARP.

Recent news that an additional 2.4 million American consumers had their personal information stolen during the Equifax data breach shows the need for a law making credit freezes free in Hawai‘i, said a March 1, 2018, press release from AARP.

HB2342 HD1, is poised to cross over to the Senate next week. The bill will eliminate the fee that credit reporting agencies can charge consumers to place and remove a credit freeze, also known as a security freeze.

“The new revelation about data breaches at Equifax shows how vulnerable people in Hawai‘i are to identity theft,” said Barbara Kim Stanton, the AARP Hawai‘i state director. “Credit freezes are one of the most effective ways to protect consumers from identity theft and Hawai‘i residents should not have to pay to protect their personal information.”

Current Hawai‘i law allows credit reporting agencies to charge a fee of up to $5 for each request to the agency to place or remove a freeze. There are three major credit reporting agencies—Equifax, Experian and TransUnion—so it can cost up to $15 every time you freeze your credit. It will cost $15 again if you want to lift the freeze to apply for a loan and another $15 to put the freeze back in place.

A credit freeze works because it allows you to choose who gets to see your credit report. It prevents identity thieves from seeing your credit report if they try to open an account in your name, but still allows you to authorize the release of your information if you need to apply for a loan or other credit.

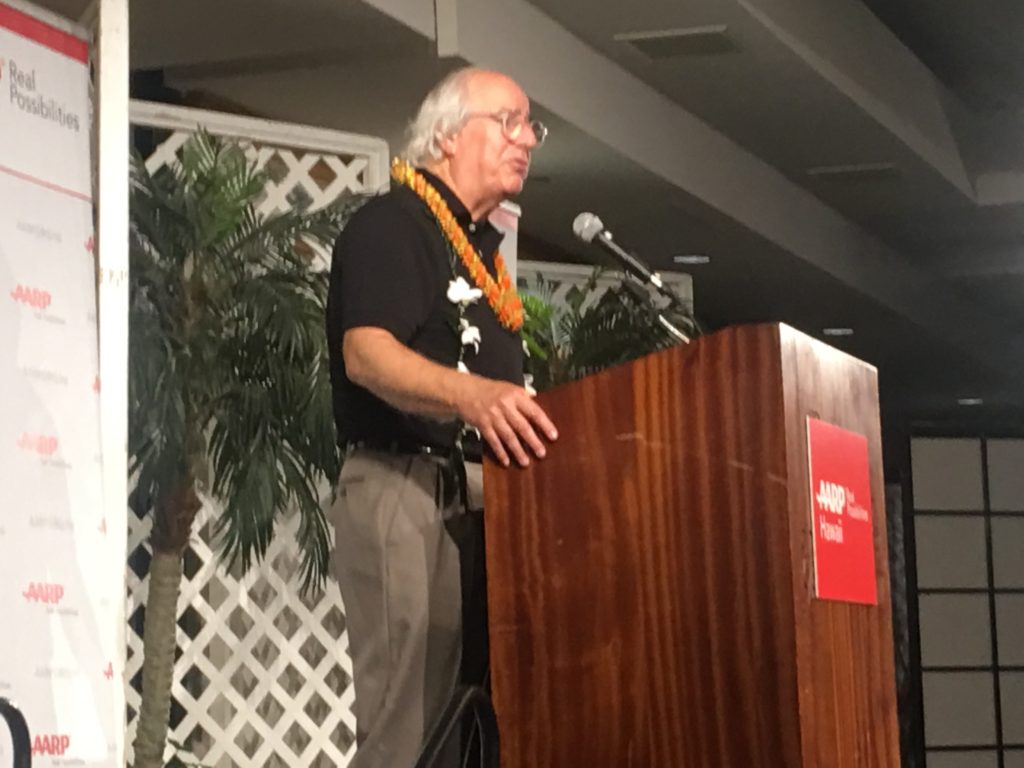

Last year, AARP Fraud Watch Network Ambassador Frank Abagnale spoke at identity theft prevention workshops on O‘ahu and Maui. He told us about how he helped pass the nation’s first law in South Carolina, his home state, to make credit freezes free. Since then other states, including Indiana, Maine and North Carolina, have passed similar laws and the Department of Commerce and Consumer Affairs had bills introduced this session to make credit freezes free in Hawai‘i.

Abagnale, one of the nation’s top identity theft experts, was the real-life inspiration for the movie “Catch Me if You Can.” While just a teenager, he stole millions of dollars from banks and airlines until his arrest. He turned his life around and now an author and consultant to the FBI and private businesses on preventing fraud and identity theft.

As he told us last year and in testimony on the Hawai‘i bill: “There should be no reason for a fee because then that becomes a deterrent to people actually freezing their credit. The American consumer never told credit reporting agencies, ‘I give you permission to store my personal information.’ We didn’t sign a piece of paper that said Equifax can store my name and date of birth. We never authorized that. Why should we be paying a fee to have control over our information?”