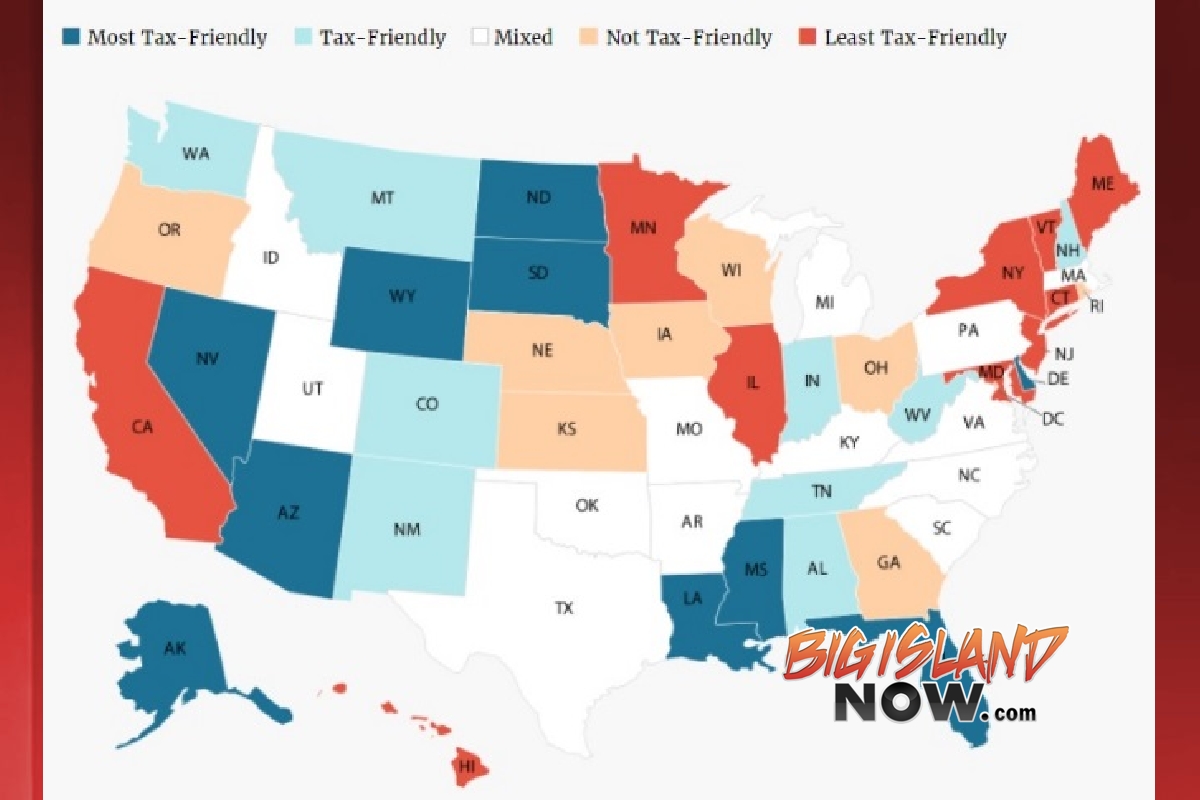

Hawai‘i is Among Top 10 Least Tax-Friendly States

Kiplinger has released its rankings of the best and worst states for taxes. The list was unveiled as part of Kiplinger’s fifth annual Tax Map which reveals income taxes, sales taxes, gas taxes, “sin” taxes (for products such as alcohol and tobacco) and other tax rules and exemptions across all 50 states and Washington, D.C.

“As Congress mulls a new federal tax plan that may cut rates and eliminate deductions, Americans should also keep an eye on state and local taxes,” said Robert Long, managing editor at Kiplinger.com. “Depending on where you’re living, state income taxes and property taxes cost thousands of dollars every year. Now, more than ever, Kiplinger’s tax map is an essential tool for people of all ages, backgrounds and career stages.”

The 10 Most Tax-Friendly States:

- Wyoming

- Alaska

- South Dakota

- Florida

- Nevada

- North Dakota

- Delaware

- Arizona

- Louisiana

- Mississippi

The 10 Least Tax-Friendly States:

- Maryland

- Minnesota

- New York

- Illinois

- Maine

- Vermont

- Hawai‘i

- California

- Connecticut

- New Jersey

The 2017 Kiplinger Tax Map features comprehensive tax profiles of each state, a list of the 10 most tax-friendly states and a list of the 10 least tax-friendly states, as well as additional roundups including states with the highest and lowest gas taxes, no income taxes, highest sales taxes and more.