FAQ: Calculating Your Potential Property Tax Increase

In a previous analysis piece, Big Island Now reviewed Mayor Billy Kenoi’s proposed 2013-2014 budget for Hawaii County.

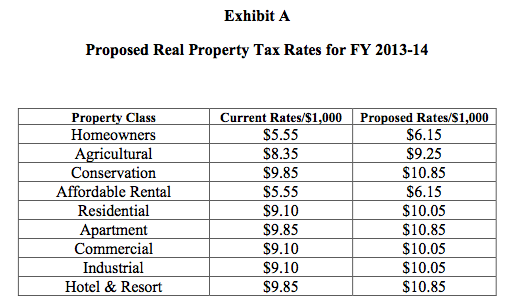

As part of his budget requests, the mayor is seeking tax increases ranging between 10.2% and 10.8% for different property classes.

In response to questions from our readers, we reached out to the mayor’s office to find out how exactly the new taxes would affect each property class on the Big Island. The mayor’s staff responded by providing us with a chart comparing both old and new property tax rates.

To calculate your potential tax increase, first find the total taxable value of your property (also known as net taxable value). If you do not know it offhand, you may look it up on the county property tax site using your tax map key or address.

You can also obtain your key by entering your address at sites like Zillow.com or simply by phoning the property tax office for your info at (808) 961-8201 in Hilo or (808) 323-4880 in Kona.

It is important to remember that your tax bill may not be based off the “tax assessed value” listed on many real estate websites, as they do not include the many deductions available from the county. “Total taxable value” includes these exemptions.

To compute your potential tax bill, first divide your property’s total taxable value by 1,000. Then, multiply that result by the proposed rate provided for your property class in the chart below. That will give you the expected yearly tax rate under the mayor’s proposal. Simply divide that number by 12 if you wish to know your monthly figure.

So, for example, a homeowner (meaning the property is your primary residence) with a total taxable value of $300,000 would divide by 1,000 to get his/her multiplier of 300. 300 x 6.15 (the homeowner tax rate) will yield a yearly property tax of $1,845 ($153.75 per month).*

It is important to remember that your tax value may fluctuate from year to year depending on your property’s assessment. Hawaii county’s tax year begins on July 1, and this year’s tax bills (including the latest tax valuations) will be mailed out to property owners on July 20, 2013.

*Note: you may obtain the same result by multiplying your total taxable value by the tax rate, and dividing by 1,000.